The Rise of Data Analysis in the Indian OTT market: The Case of Ormax Media

Ishita Tiwary / Concordia University

Last year on the popular chat show Koffee with Karan, ace Bollywood producer, director, and host of the show Karan Johar informs his celebrity guests of their number one status in the country by stating––“Have you realized they are the biggest stars right now in the country? We have, like, an Ormax survey, and he’s [Akshay Kumar] been ruling as the number one movie star on that chart. And recently they did a pan-India survey that said which is the number one female actor across the country. Number one was Samantha Prabhu” (Koffee with Karan, 2022). In the backdrop is a slide titled Ormax Stars India Loves (All India): Most Popular Female Stars.” At the time of writing this column, several new outlets carried the story that the show ‘Farzi’ (trans. Fake) was the most watched Indian original streaming show ever with over 4 crore (40 million) streams by citing data from Ormax. What is Ormax Media? It is self-described as India’s only specialized media consulting firm and the go-to tracker for everyone in the entertainment business. From content testing to tracking the most popular stars/shows/films, data from Ormax is becoming crucial to decisions such as marketing budget, scripting decisions, casting decisions etc. to the Indian OTT industry. Long and Vadde (2023) make a distinction between ‘watching TV and talking TV’–– the former captures a cross section of audience attention and the latter feeds into social rituals such as tweeting, posting on forums online etc. In the world of streaming where numbers and the meaning of success is opaque and with several of my respondents turning to social media to gauge the success of their show, Ormax becomes a crucial point to interrogate the relationship between OTT (Over the Top) platforms, audience engagement, taste making, and data analysis in India.

The online video streaming market in India has witnessed unprecedented growth, increasing from eight streaming platforms to 46 in 2022 and has the potential to become a market worth USD$13-15 billion over the next decade (BCG, 2018, 2021). Despite the buzz around global Streaming Video on Demand (SVOD) service providers (Netflix and Amazon Prime Video), the Indian field is dominated by the digital arm of established local TV channels Star, Sony, Zee TV (HotStar, Sony LIV, Voot, Zee5). According to Ormax the total audience for OTT platforms rose 13.5% to reach 481.1 million in 2023 from 423.8 million in 2022. Streaming apps have now reached 34% of India’s population of 1.4 billion after a 20% surge the previous year (Jha, 2023). Shailesh Kapoor, founder and chief executive of Ormax, states that this growth rate isn’t low, especially since penetration in rural areas and small towns (which make up a sizable part of the population) stands only at 23% compared to the pan-India figure of 34%. OTT platforms now face the challenge of whether consumption can grow beyond the top 20 cities, he added (Ibid). His comments alert us to the importance of data collection and analysis in the Indian OTT context.

Studies on Indian OTT platforms have focused on the role of languages and diversity vis-à-vis localization (Mehta, 2020; 2021) on regulatory debates (Fitzgerald 2020), informality (Kumar, 2019), and on its genealogies (Punathembekar and Kumar, 2022). Given the size of India’s market (being one of the fastest growing markets and potentially the largest market) and the amount of content it churns out, data becomes a crucial vector to understand OTT dynamics in the country.

Ormax was founded by Vispy Doctor and Shailesh Kapoor. Vispy had a qualitative research company that was around for 30 years and Shailesh had a background in TV and media. Ormax had done work for the TV side and this is how Shailesh and Vispy met and this is where the genesis of Ormax as a media consulting firm began. Moreover, OTT platforms in India took off in 2016 when Netflix entered the market which led to an increase in commissioning and acquiring content as well as bidding for cricket matches. Unlike the theatrical and television industry, streaming does not have an independent body that tracks viewership.

For producers, measuring the performance of a piece of content on OTT is hard because everything is so fluid… Technology keeps changing, new platforms keep coming up or going away. Every platform will give you some data about how well your show has performed, but it’s all geared towards showing how well their platform is doing over rivals

Gupta, 2023

Keerat Grewal, who heads the streaming part of Ormax told me,

Media is a fairly new industry India at least, so it’s not as matured as FMCGs. So obviously metrics were being set in place, but one understood that one could not apply the same metrics that you apply to something that you pick off the shelf versus what you engage in day on day, good amount of money and go and watch in a theatre, right. Because the metrics and your engagement, your emotional engagement are very different. So that’s where Ormax Media came into being. That we started off as being a firm which tried to bring in metrics to evaluate media content, right? And over time, we have been able to position ourselves as a consulting firm which takes consumer research as an input

Grewal, 2023

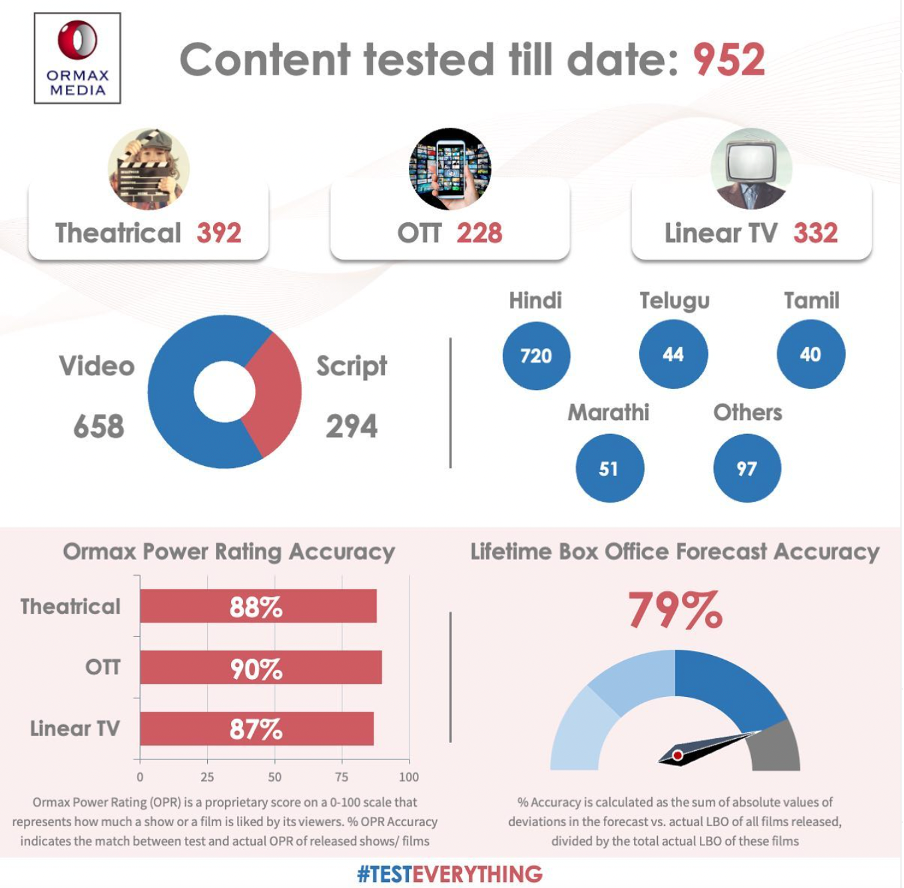

Ormax claims to not use secondary data, they conduct their own consumer research, have their trackers in place, and built their own tools for testing content. They also work for brands,

…we don’t work for brands for typical brand track kind of work because we don’t have domain expertise in FMCG or white goods or BFSI. But when any of these categories integrates themselves with content, whether it’s know, high ticket advertising and an, you know, kind of integrating themselves in OTT content, that’s where we come in, because we have content understanding and domain understanding that comes in.

Grewal, 2023

The company also has a linear broadcast and theatrical division.

Currently, Ormax data dominates the industry and is considered sacrosanct by both the industry and the press. It has an inordinate amount of influence in commissioning and making of content––a development that is very new to the Indian media industry. Scholars of SVOD and platforms generally are critical of the role of data. Amanda Lotz critiques Parrot Analytics and the Netflix Top 10 as it does not accurately give a picture of audience engagement and attention given to the content by the consumers. Marc Steinberg questions the use of data in the Japanese context where Netflix is considered very big, but the data does not take into consideration that Netflix is 5 times more expensive than other local streaming services and is only looking at the absolute revenue numbers. I gesture towards these scholars as they alert us to the dangers of taking data at absolute face value. In the case of Ormax, concerns have been raised regarding its data collection through its design (who is the audience), execution (framing of questions, how are they posed, are they aided/unaided), and the size of the survey. In this post, I introduced the context of data and OTT platforms in India via Ormax. In the next post, I go deeper and delineate the research methodologies designed and implemented by Ormax and its impact in the OTT space in India.

Image Credits:

- Instagram page of Ormax Media (author’s screen grab)

- Koffee with Karan (author’s screen grab)

- Firstpost (author’s screen grab)

- Instagram page of Ormax Media (author’s screen grab)

Fitzgerald, Scott, ‘Over the Top Video Services in India: Media Imperialism after Globalization’, Media Industries Journal, 6 (2), 89-115, 2020

Grewal, Keerat. Interview conducted on 24 May, 2023.

Gupta, Soumya, ‘How Ormax Made it’, The Signal, 31 March 2023, Available at < https://daily.thesignal.co/p/ormax-koffee-with-karan-samantha-prabhu> Accessed on 17 Nov 2023

Jha, Lata, ‘Streaming Growth Slows Post Boom’, Live Mint, 5 Nov, 2023. Available at < https://www.livemint.com/industry/media/streaming-growth-slows-after-boom-11699206248093.html> Accessed on 17th Nov, 2023

Long, Hoyt and Aarthi Vadde, ‘We want our Catastrophe TV’, Public Books, 11 Nov, 2023. Available at < https://www.publicbooks.org/we-want-our-catastrophe-tv/>. Accessed on 17 Nov 2023

Kumar, Akshaya, Informality in the time of Platformization, Media Industries, Vol 6, Issue 2, 2019

Mehta, Smith. “Television’s role in Indian new screen ecology.” Media, Culture & Society, Vol 42, nos. 7-8: 1226-1242. 2020

Mehta, Smith. “Indian intermediaries in new media: Mainstreaming the margins.” Convergence, Vol 27, no.1: 229-246. 2021

Punathambekar Aswin and Shanti Kumar, ‘Hotstar: Reimagining Television Audiences in Digital India’ in Derek Johnson ed. From Networks to Netflix: A Guide to Changing Channels’, Routledge, 2022

Steinberg, Marc, ‘Abema TV: Where Broadcast and Streaming Collide’, in Derek Johnson ed. From Networks to Netflix: A Guide to Changing Channels’, Routledge, 2022